https://www.onlineed.com/catalog/1305/1-Hour-NV-SAFE-Nevada-Qualified-Employee-Mortgage-Continuing-Education

1 Hour NV SAFE: Nevada Qualified Employee Mortgage Continuing Education

1-hour Nevada state-specific course for licensed Qualified Employees.

$19.50 | 1 Hour

+ $1.50 NMLS Credit Banking Fee

1 Hour NV SAFE: Nevada Qualified Employee Mortgage Continuing Education

NMLS Course ID: 16004

NMLS Sponsor ID: 1400327

Credit Hours Provided: 1

The Nevada Division of Mortgage Lending (the Division) requires mortgage company and mortgage servicer qualified employees to take a 1-hour course covering Division-defined mortgage regulation topics as part of the QE's annual continuing education requirement. This course covers topics relating to Nevada qualified employees.

The Nevada Division of Mortgage Lending (the Division) requires mortgage company and mortgage servicer qualified employees to take a 1-hour course covering Division-defined mortgage regulation topics as part of the QE's annual continuing education requirement. This course covers topics relating to Nevada qualified employees.

Each licensed mortgage company must have a qualified employee at each location licensed with the Nevada Division of Mortgage Lending. (NRS 645B.021; NAC 645B.030)

A qualified employee is a natural person who is designated by a mortgage company to act on behalf of the mortgage company and who is approved by the Commissioner. (NAC 645B.008

The first module of this course is an introduction and an overview of the Division. The second module is an outline of the additional requirements for mortgage companies located in Nevada Administrative Code (NAC) 645B and Nevada Revised Statutes (NRS) 645B such as responsibilities, record keeping requirements, and advertisement restrictions. The third module examines other covered services supervised by the Division, such as foreclosure consultants, loan modification consultants, and mortgage servicers. The fourth and last module categories a variety of unfair mortgage lending practices that are prohibited as codified in NRS 598D.

Topics and Learning Objectives

This Nevada QE online continuing education course is broken down into several learning topics. At the end of the course a 15-question final exam will be given. The topics included in this course are:

The Nevada Division of Mortgage Lending

The Operation of Mortgage Companies

Mortgage Lending and Related Professions

Unfair Lending Practices

Final exam

Total study time: 1 hour (50 minutes)

This course will prepare Nevada licensed qualified employees to:

Recognize the importance of a licensee's fiduciary duty to consumers.

Identify the regulatory agency who enforces Nevada's mortgage licensing regulations.

Review the requirements for obtaining a mortgage company license.

Describe the requirements for a mortgage brokerage qualified employee.

Identify the retention period for transaction files.

Demonstrate the disclosure requirements when working as both a mortgage and a real estate licensee.

Review the rules when advertising and promoting mortgage products to consumers.

Identify what a covered service is.

Summarize who is defined as a foreclosure or loan modification consultant.

Review the initial and supplemental disclosure requirements for covered service providers.

Describe the record keeping requirements for foreclosure or loan modification consultants.

Classify how a person obtains authorization to become a mortgage servicer.

Paraphrase a mortgage servicer's fiduciary responsibilities to their clients.

Outline the protection given to government employees when experiencing a temporary government shutdown.

Outline several prohibited unfair lending practices relating to homeowner insurance, ability to repay, prepayment penalties, and credit insurance.

Describe available remedies for borrowers who are holding onto a mortgage loan originated using unfair lending practices.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

- Login into NMLS

- Click on the Composite View tab.

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center.

This course will remain available to students until midnight on December 31st, 2024

Learn More

Key Features

Online Course

Online Audio

Printable Certificate

PDF & EPUB eBook

Package Summary

| Price: |

$19.50 (USD)

+ $1.50 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 1 |

| State: | Nevada |

| Category: | Vocational Training > Mortgage > Continuing Education > Nevada |

| Purpose: | 1-hour Nevada state-specific course for licensed Qualified Employees |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

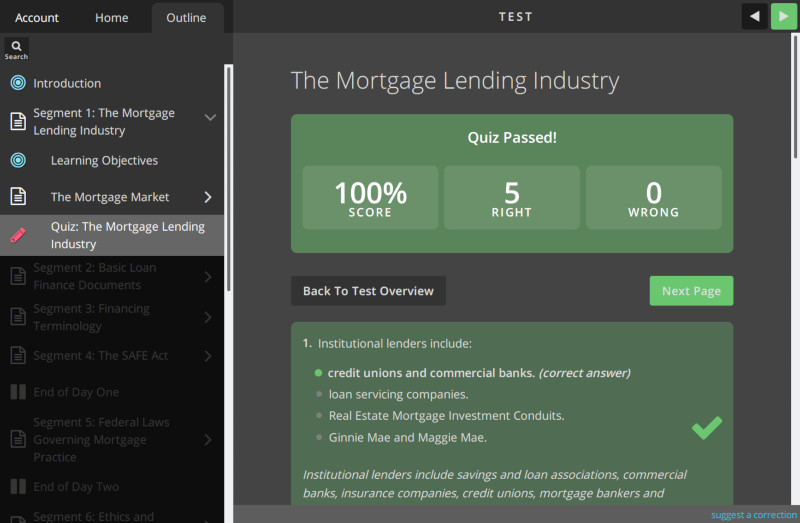

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

Nevada Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.