https://www.onlineed.com/catalog/1439/30-hour-nevada-mortgage-pre-license

30 Hour Nevada Mortgage Pre-License Education

Complete education for obtaining a mortgage loan originator license with the Nevada MLD. Includes test-taking strategy video.

$350.00 | 30 Hours

+ $45.00 NMLS Credit Banking Fee

This mortgage pre-license course package contains all of the NMLS-required education you need to become licensed as a mortgage loan originator in Nevada. This package includes:

-

20 Hour SAFE Comprehensive: Mortgage Loan Originator Prelicensure Course - This required course teaches you the basics about what mortgage loans are, discusses federal laws, ethics, mortgage types, how to fill out a mortgage application, and closing procedures. This course is in "online instructor-led" format. It begins and ends on a fixed schedule that you choose. The course includes opportunities to ask questions and get feedback from your instructor. There will also be an optional live weekly review session with your instructor via online webinar. This mortgage loan originator NMLS pre-licensing course is structured to be completed in a 4-day class. Each chapter features a Question & Answer page to submit questions and get feedback from the instructor. Students may take a final exam starting on day 4 of the class but may take up to 14 days to finish the class.

-

4 Hour NV SAFE: Nevada Mortgage Lending Laws Course - This course presents Nevada law and rule requirements relating to originating mortgage loans securing residential real property located throughout the State of Nevada. The purpose of this training is to prepare NV Mortgage Loan Originator license candidates with the necessary information to ensure fair, ethical, and compliant mortgage loan origination activities. This is an "online self-study" course that you can complete at your own pace.

-

Choose Your Own Electives - Nevada requires a total of 30 hours to complete your license training. The required topics only make up 24 hours. Choose 6 additional hours from our catalog of neighbor-state licensing courses (CA-DFPI, OR, WA, ID, MT, NM, AZ). This will let you apply for a license in those states too!

-

Test Prep Course - This optional, self-paced exam-cram course helps you study for the licensing exam after your required courses are completed. It reviews all of the topics in the 20-hour pre-license course using points to remember, video, and quiz questions. At the end is an "exam simulator" based on the same requirements as the licensing exam.

-

SPECIAL BONUS: Licensing Exam Test-Taking Strategy Video Course - A special feature you won't find anywhere else! This is a 2-hour coaching video that will present tips on how to pass the national mortgage loan originator licensing exam. Topics include how to schedule the exam, what to expect on arrival, test taking techniques, and review of the NMLS test content outline.

Frequently Asked Questions

What is an "Online Instructor-Led" course?

Students progress through a class under the guidance of an instructor. Classes will begin on a fixed date. Each day, students will work through online course material, take review quizzes, view review videos, and optionally participate in Question & Answer forums. The instructor will hold an optional weekly review session via live webinar, usually held on Fridays. This is a chance to review course material, ask additional questions, and prepare for the licensing exam.

How long does the 20-hour class take?

The instructor will guide the class for the first 4 days, after which students may access the final exam. All students must complete the required 20 study hours in the course. Courses MAY be completed on the 4th day, but MUST be completed with 14 days. Courses not completed in 14 days are marked as failed.

Is attending the weekly review webinar required?

No, but highly recommended. It is your opportunity to get questions answered from your instructor in a live setting with fellow students.

How fast can I complete the 20-hour course?

4 days. The final exam becomes available at the end of the 4th day of class for students who have completed the required study time.

Can I get my course extended if I need more time?

No. The NMLS requires all instructor-led courses to be completed within 14 days.

Learn More

Key Features

U-Pick Courses

Online Materials

Includes Video

Online Audio

Optional Q&A Webinar

State Component

Printable Certificate

PDF & EPUB eBook

Practice Tests

Test Simulator

Test-Taking Strategies

Online Flashcards

Mortgage 101 Bootcamp Add +$99.00

Package Summary

| Price: |

$350.00 (USD)

+ $45.00 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 30 |

| State: | Nevada |

| Category: | Vocational Training > Mortgage > License Training > Nevada |

| Purpose: | Complete education for obtaining a mortgage loan originator license with the Nevada MLD. Includes test-taking strategy video. |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

- 20 Hour SAFE Comprehensive - Mortgage Loan Originator Pre-Licensure Education Course Enrollment Agreement

- 4 Hour NV SAFE: Nevada Mortgage Lending Laws Enrollment Agreement

- 2 Hour ID SAFE: Idaho Mortgage Lending Laws Enrollment Agreement

- 4 Hour AZ SAFE: Arizona Mortgage Lending Laws Enrollment Agreement

- 2 Hour CA-DFPI SAFE: California Mortgage Lending Laws Enrollment Agreement

- 4 Hour OR SAFE: Oregon Mortgage Lending Laws Enrollment Agreement

- 4 Hour WA SAFE: Washington Mortgage Lending Laws Enrollment Agreement

- 3 Hour NM SAFE: New Mexico Mortgage Lending Laws Enrollment Agreement

- 2 Hour MT SAFE: Montana Mortgage Lending Laws Enrollment Agreement

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

Nevada Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.

Courses Available In This Package:

20 Hour SAFE Comprehensive - Mortgage Loan Originator Pre-Licensure Education Course

NMLS Course ID: 6121

NMLS Sponsor ID: 1400327

Credit Hours Provided: 20

This 20-hour mortgage loan originator pre-license course will teach you the various aspects of the mortgage lending industry such as loan finance documents, the laws that must be followed, the importance of ethical conduct, how to watch out for fraud and other nefarious acts, how to complete a loan application and the process for loan approval, and various different loan programs that are available to consumers.

Some states require state-specific prelicense education in addition to the standard course. Please check with your state regulatory agency, the NMLS, or contact us to verify if the jurisdiction you are becoming licensed under requires additional state-specific training.

Course Content

This course is divided into 12 chapters:

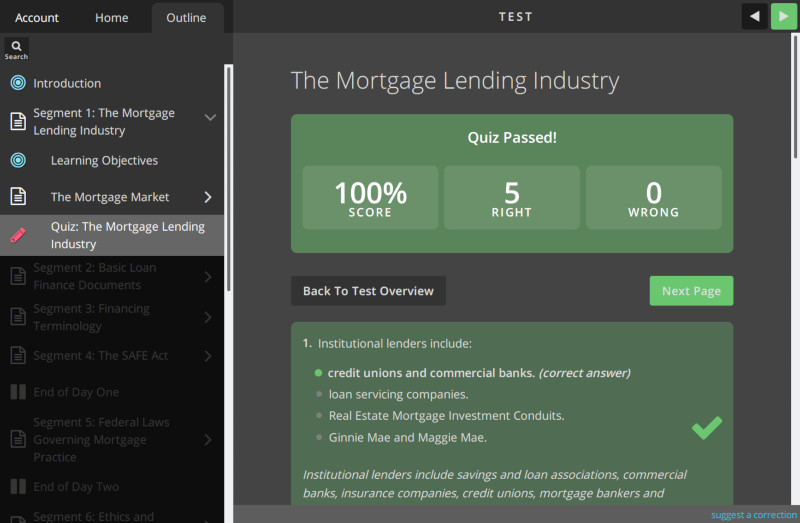

- Segment 1: The Mortgage Lending Industry

- Segment 2: Basic Loan Finance Documents

- Segment 3: Financing Terminology

- Segment 4: The SAFE Act

- Segment 5: Federal Laws Governing Mortgage Practice

- Segment 6: Ethics and Consumer Protection

- Segment 7: Fraud and Money Laundering

- Segment 8: The Mortgage Loan Application

- Segment 9: Processing and Underwriting

- Segment 10: Closing

- Segment 11: Financial Calculations

- Segment 12: Specific Loan Programs

This mortgage loan originator pre-license course is structured to be completed in a 4-day class. As required by the Nationwide Multistate Licensing System (NMLS), sections of the course will unlock as the class moves together through the course material, ensuring that no student moves faster than the rest of the class.

Each chapter will include a Question & Answer bulletin board to allow students ask questions of the instructor and get feedback. Quizzes are given throughout the course. Each day includes review videos by the instructor to highlight important concepts.

The online final exam will be presented at the end of the course. The final exam is not timed, contains 25 multiple choice questions, and requires a 70% or higher passing score. Students can take multiple attempts at passing the final exam, with each attempt containing a new set of test questions. The final exam must be completed before the end of the 14-day class session to receive credit for passing the course.

NMLS functional specifications define that a 20-hour mortgage loan originator prelicense courses MUST be completed within 14 days of the course session start date. Students who do not pass the final exam before the enrollment period expires will be marked as failing the course. Refunds will not be issued for failed courses. Extensions to lengthen the 14-day enrollment period are NOT available. Students who fail the course can enroll for a new course session and must start from the beginning.

After successfully passing the final exam, OnlineEd will notify the Nationwide Multistate Licensing System (NMLS) that the mortgage loan originator pre-education has been completed by the student. It is OnlineEd policy to have credit uploaded to the NMLS by the end of the following business day.

The student will have a printable course completion certificate available after passing the course final exam. The certificate is for the student's personal records and is not confirmation that the NMLS has received the notification that the student has completed the course.

Special Live Session

Each class will have the opportunity to participate in a live webinar session with the instructor. It is a chance to review material from the course, study for the exam, and discuss the licensing process. This session is optional but highly encouraged.

Technical Requirements

This is an online, instructor-led mortgage loan originator pre-license course that contains online reading materials, audio presentations, and video presentations. Students will need to have a current internet browser and computer speakers. The instructor-led webinar sessions are presented using the Zoom conferencing platform. A webcam is NOT required. An audio bridge call-in number along with confirmation of the webinar session times will be emailed to students after registering for the live instructor session.

NMLS Unique ID is Required

You will need a NMLS Unique ID number in order for us to upload record of your course completion to the NMLS. If you already have an NMLS ID but don't remember what it is:

Login into NMLS

Click on the Composite View tab.

Click View Individual on the sub-header row.

The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center:

Learning Module Outline

Segment 1: The Mortgage Lending Industry

Total study time: 30 minutes

This segment will give you an overview of the mortgage lending industry. Students will learn about various types of lenders and the parties who are involved in the mortgage lending process.

Segment 2: Basic Loan Finance Documents

Total study time: 30 minutes

This segment will explain the various promissory notes that are available. Students will also learn the three main types of security instruments used in residential purchase transactions.

Segment 3: Financing Terminology

Total study time: 1 clock hour

There are many terms and words used within the mortgage industry that aren't a part of the everyday person's vocabulary. This segment will outline many common words and loans used in the lending industry.

Segment 4: The SAFE Act

Total study time: 1 clock hour

After the passage of the SAFE Act, a national registration system was created that allowed states to use a centralized system to supervise the licensing of individuals and companies. This segment will explain the SAFE Act and its implications on the mortgage industry

Segment 5: Federal Laws Governing Mortgage Practice

Total study time: 4.5 clock hours

This segment will outline many of the important federal regulations and rules that students will need to comply with when working with borrowers on residential loan transactions.

Segment 6: Ethics and Consumer Protection

Total study time: 1 clock hour

Interacting with the public must always be done in an ethical manner. There are many courtesy standards that should be followed, as licensees are expected to protect the loan applicant's interests and not take an unfair advantage of an applicant in order to earn a commission.

Segment 7: Fraud and Money Laundering

Total study time: 1 clock hour

This segment will outline the ways in which loan fraud is used for illegal activities, the programs that companies are expected to create to detect fraud, and the various ways that criminals try to trick lenders (and mortgage loan originators) into financing their property purchases.

Segment 8: The Mortgage Loan Application

Total study time: 2.5 clock hours

This segment will outline both the standard loan application and the Loan Estimate disclosure. Students will also learn about credit scores and what to look out for when working with documents submitted by applicants to support their personal financial obligations.

Segment 9: Processing and Underwriting

Total study time: 30 minutes

Appraisals are often used to confirm that the property being used as collateral for the loan is adequate in case of borrower default. If the lender has to take the property and sell it, the property should be worth enough money for the lender to recoup its financial loss.

Segment 10: Closing

Total study time: 2 clock hours

In this segment students will learn about the RESPA Closing Disclosure. This form is in conjunction with the earlier Loan Estimate and discloses the final details of the approved loan to the borrower.

Segment 11: Financial Calculations

Total study time: 30 minutes

Financial transactions naturally involve a lot of math calculations; the amount to be repaid monthly, how much interest a loan will accrue during its term, and so on. Students will also need to be able to take the income and debt values supplied by the loan applicant to determine if he or she will even meet the minimum qualifications for the loan being applied for.

Segment 12: Specific Loan Programs

Total study time: 2 clock hours

There are a variety of loan programs available for applicants to qualify for. This segment will give students an overview of a variety of loan programs that borrowers can apply for.

This course will remain available to students for 14 days after enrollment.

Mortgage Loan Originator Prelicense Exam Prep

This course is a study guide to help licensee applicants prepare for the mortgage loan originator licensing exam. Each chapter of this course contains a study exam of test questions that students can use to help retain the information taught during the 20-hour national prelicense course.

The topics covered in this course are:

- Segment 1: The Mortgage Lending Industry

- Segment 2: Basic Loan Finance Documents

- Segment 3: Loan Types and Terminology

- Segment 4: The SAFE Act

- Segment 5: Federal Laws Governing Mortgage Practice

- Segment 6: Ethics and Consumer Protection

- Segment 7: Fraud and Money Laundering

- Segment 8: The Mortgage Loan Application

- Segment 9: Processing and Underwriting

- Segment 10: Closing

- Segment 11: Financial Calculations

- Segment 12: Specific Loan Programs

Each chapter's study exam presents a large number of questions for students to test themselves on. As each question is graded as correct, the number of questions available in the chapter's prep test will be reduced until the student has correctly answered all of the questions in the chapter. Progress can be reset at any time if the student wants to be presented with all of the chapter's test questions again.

At the end of the course is a test based on the same timing requirements as the NMLS MLO licensing exam. The test will present 125 questions in a random order. Students will have 190 minutes to achieve a 75% or higher passing score. This sample exam may be attempted as many times as desired.

Completing this module is not necessary for earning credit towards completing the prelicense education requirements to earn a mortgage loan originator license.

This course will remain available to students for 365 days after enrollment.

4 Hour NV SAFE: Nevada Mortgage Lending Laws

NMLS Course ID: 14041

NMLS Sponsor ID: 1400327

Credit Hours Provided: 4

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Nevada under The Division of Mortgage Lending (MLD), an agency under the Nevada Department of Business and Industry. This 4-hour course covers state-specific rules and regulations in Nevada, and is required as part of the 30 hours of pre-license education needed to become a Nevada licensed mortgage loan originator. This course covers only state-specific content. The remainder of your required 30-hour pre-license education will be covered by additional separate courses.

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Nevada under The Division of Mortgage Lending (MLD), an agency under the Nevada Department of Business and Industry. This 4-hour course covers state-specific rules and regulations in Nevada, and is required as part of the 30 hours of pre-license education needed to become a Nevada licensed mortgage loan originator. This course covers only state-specific content. The remainder of your required 30-hour pre-license education will be covered by additional separate courses.

Course Topics

This course consists of 5 modules and a final exam:

Introduction (15 minutes)

Mortgage Licensing (38 minutes)

The Operation of Mortgage Companies (71 minutes)

Foreclosure Service Providers (21 minutes)

Unfair Lending Practices (35 minutes)

Final Exam (20 minutes)

Total study time: 4 credit hours (200 minutes)

Module 1: Introduction

In this module we are going to discuss Nevada law and rule requirements relating to operating a mortgage business in Nevada. The laws relating to how a mortgage loan originator is to operate and conduct their affairs are based upon both statutory and administrative rules.

Module 2: Mortgage Licensing

In this module we'll introduce you to the steps for obtaining a mortgage loan originators in Nevada. An MLO license can only be grated to a natural person (i.e., an individual) who completes the necessary requirements for being authorized by the Nevada Division of Mortgage Lending to participate in residential mortgage origination activities with the expectation of compensation. MLOs work with clients to locate a mortgage product that best fits within the clients' financial means.

Module 3: The Operation of Mortgage Companies

The previous module covered licensing matters for individual mortgage loan originators. Now we turn our attention to the licensing and operating of mortgage companies. This will include escrow and trust accounts, appropriate consumer disclosures, advertisements, responsibilities when handling employees, and prohibited acts.

Module 4: Foreclosure Service Providers

This module covers various consumer protections in relation to foreclosure consultations, loan modifications, and loan servicing.

Module 5: Unfair Lending Practices

Unfair lending practices set homeowners up for failure. By lending individuals more money that their homes are actually worth, consumers are often unaware of what they agree to until it is too late. In this module we'll review unfair lending practices as outlined in Nevada Revised Statutes 598D. Nevada has defined certain practices as unfair lending practices and has prohibited lending in these capacities.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

Login into NMLS

Click on the Composite View tab.

Click View Individual on the sub-header row.

The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center.

This course will remain available to students for 365 days after enrollment.

2 Hour ID SAFE: Idaho Mortgage Lending Laws

NMLS Course ID: 13006

NMLS Sponsor ID: 1400327

Credit Hours Provided: 2

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Idaho under the Idaho Department of Finance (the Department). This 2-hour course covers Idaho specific rules and regulations as mandated by the Department, and is required as part of the 20 hours of prelicensure education needed to become an Idaho-licensed mortgage loan originator.

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Idaho under the Idaho Department of Finance (the Department). This 2-hour course covers Idaho specific rules and regulations as mandated by the Department, and is required as part of the 20 hours of prelicensure education needed to become an Idaho-licensed mortgage loan originator.

Topics and Learning Objectives

This course consists of four modules and a final exam:

The Idaho Department of Finance

- Licensing and Examinations

- Records, Procedures, and Advertising

- Prohibitions, Investigations, and Enforcement

- Final Exam

Total study time: 2 credit hours

Module 1: The Idaho Department of Finance

The Idaho Department of Finance (the "Department") was created by the Idaho State Legislature in 1905 with the purpose of regulating the Idaho financial services industry. The Department was initially responsible for administering the Idaho Bank Act, which solely governed banks. This module reviews the Departments and its bureaus.

Module 2: Licensing and Examinations

Understanding compliant Idaho mortgage loan origination practices and procedures requires an exploration of the Idaho Residential Mortgage Practices Act (IRMPA), codified in Idaho Code (IC) Title 26, Chapter 31. Through this legislative agenda, we will review required practices, compliance, considerations, and prohibitions of mortgage professionals operating throughout Idaho.

Module 3: Records, Procedures, and Advertising

The Idaho Residential Mortgage Practices Act outlines the responsibilities of mortgage brokers and lenders when it comes to recordkeeping, disclosures, and reporting. This module will cover a licensee's duty with regards to their files, their advertisements, and their NMLS ID. We'll also discuss the Idaho mortgage recovery fund, a reserve set aside for paying consumers who were wronged by the acts of unethical mortgage licensees. Money paid into the fund comes from fees collected at initial licensing and at license renewal, with mortgage branch and home licensees paying more into the mortgage recovery fund then mortgage loan originator licensees.

Module 4: Prohibitions, Investigations, and Enforcement

The Idaho Residential Mortgage Practices Act (IRMPA) establishes actions, behaviors, and practices which Idaho-licensed mortgage lenders and brokers are prohibited from committing. Idaho-licensed mortgage loan originators are equally prohibited from violating the IRMPA through the commission of prohibited conduct. In this module, we'll cover actions that can jeopardize a licensee's good standing with the Department.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

Login into NMLS

Click on the Composite View tab.

Click View Individual on the sub-header row.

The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center.

This course will remain available to students for 365 days after enrollment.

4 Hour AZ SAFE: Arizona Mortgage Lending Laws

NMLS Course ID: 11808

NMLS Sponsor ID: 1400327

Credit Hours Provided: 4

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Arizona under the Arizona Department of Financial Institutions (DFI). This 4-hour course covers Arizona specific rules and regulations, and is required as part of the 20 hours of prelicensure education needed to become an Arizona mortgage loan originator.

Topics and Learning Objectives

This course consists of five modules and a final exam:

- Mortgage Broker Licensing and Regulations (40 minutes)

- Mortgage Banker Licensing and Regulations (50 minutes)

- Mortgage Loan Originator Licensing and Regulations (40 minutes)

- The AZDFI Mortgage Recovery Fund (30 minutes)

- AZDFI Disciplinary Actions (20 minutes)

- Final Exam (20 minutes)

Total study time: 4 credit hours (200 minutes)

Module 1: Mortgage Broker Licensing and Regulations

In this module we will cover the licensing of mortgage broker. A mortgage broker is a person who, with the expectation of being paid for their services, directly or indirectly can make a mortgage loan or can negotiate a mortgage loan. A mortgage loan is a financial arrangement secured by an interest in real property located in Arizona that is created with the consent of the real property's owner. A mortgage broker can make a mortgage loan on both residential real property and commercial real property, depending on the license status.

Module 2: Mortgage Banker Licensing and Regulations

This module will cover the licensing of Arizona mortgage bankers. A mortgage banker is a person who, with the expectation of being paid for their services, directly or indirectly can make a mortgage banking loan or can negotiate a mortgage banking loan. A mortgage banking loan is a loan funded exclusively from the mortgage banker's own resources that is directly or indirectly secured by an interest on real estate located in the State of Arizona and is created with the consent of the real property owner. Mortgage bankers can issue mortgage loans on both residential and commercial real property. A mortgage banker license also allows for the servicing (i.e., collecting payments) of mortgage loans.

Module 3: Mortgage Loan Originator Licensing and Regulations

In this chapter we'll describe the licensing of mortgage loan originators. A mortgage loan originator is a natural person (i.e., an individual) who, for the expectation of compensation, takes a mortgage loan application for a borrower, offers or negotiates the terms of a residential mortgage loan, or negotiates with a borrower's lender for a temporary or permanent loan modification. Note that mortgage loan originators do not make mortgage loans, whether residential or commercial, like mortgage brokers or mortgage bankers. MLOs act as the intermediary between a loan applicant and a mortgage lender, mortgage broker, or mortgage banker.

Module 4: The AZDFI Mortgage Recovery Fund

The Department of Financial Institutions' mortgage recovery fund can be used by the Superintendent to pay for damages caused by a malicious licensee when the licensee's surety bond cannot cover the judgment issued against the licensee. This module will explain the use of the fund by the Superintendent, how claims are filed against the fund, and how payments are issued from the fund.

Module 5: AZDFI Disciplinary Actions

As the regulatory agency assigned to oversee Arizona mortgage lending activities, the Department of Financial Institutions and its principal Superintendent have the authority to discipline licensees under its jurisdiction. The module will explain the authority granted to the AZDFI to protect financial lending consumers.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

2 Hour CA-DFPI SAFE: California Mortgage Lending Laws

NMLS Course ID: 11090

NMLS Sponsor ID: 1400327

Credit Hours Provided: 2

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in California under the Department of Financial Protection and Innovation (DFPI). This 2-hour course covers California specific rules and regulations, and is required as part of the 20 hours of prelicensure education needed to become a California mortgage loan originator under the DFPI.

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in California under the Department of Financial Protection and Innovation (DFPI). This 2-hour course covers California specific rules and regulations, and is required as part of the 20 hours of prelicensure education needed to become a California mortgage loan originator under the DFPI.

Topics and Learning Objectives

This course consists of two sections and an exam:

- California Residential Mortgage Lending Act (40 minutes)

- California Finance Lenders Law (50 minutes)

- Final exam (10 minutes)

Total Study Time: 2 credit hours (100 minutes)

Module 1: California Residential Mortgage Lending Act (CRMLA)

The activities of licensed mortgage loan originators and the origination or offering of financial products for residential real property are subject to California law. This section of the course covers MLO licensing requirements, mortgage lender licensing requirements, and the California residential lending laws the MLOs must comply with.

Module 2: California Financing Law (CFL)

An alternative to CRMLA licensing, the California Financing Law requires finance lenders and brokers to be registered before offering consumer or commercial loans in California. MLOs who are employed by finance lenders must be licensed under the CFL requirements. This section will cover finance lender and broker licensing, restrictions on fees that can be charged by CFL licensees, and other lending laws that CFL licensees must comply with.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

4 Hour OR SAFE: Oregon Mortgage Lending Laws

NMLS Course ID: 11174

NMLS Sponsor ID: 1400327

Credit Hours Provided: 4

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Oregon under the Division of Financial Regulations (DFR) under the Oregon Department of Consumer and Business Services (DCBS). This 4-hour course covers Oregon specific rules and regulations, and is required as part of the 20 hours of prelicensure education needed to become an Oregon mortgage loan originator.

Topics and Learning Objectives

This course consists of six modules and a final exam:

- Mortgage Lending General Provisions (20 minutes)

- Oregon Mortgage Lending Law and the Oregon SAFE Act (50 minutes)

- Licensing of Mortgage Bankers and Mortgage Brokers (40 minutes)

- Licensing of Mortgage Loan Originators (25 minutes)

- Dishonest, Fraudulent, Unfair, and Unethical Practices (25 minute)

- Custody and Possession of Client Funds (20 minutes)

- Final exam (20 minutes)

Total study time: 4 clock hours

Module 1: Mortgage Lending General Provisions

In this module students will start out with an introduction to Oregon loan and lending terminology, recordkeeping time frames, and correcting data submitted to the Nationwide Mortgage Licensing System and Registry (NMLSR).

Module 2: Oregon Mortgage Lending Law and the Oregon SAFE Act

All mortgage professionals operating throughout the State of Oregon must be familiar with the processes, procedures, allowances, prohibitions, and requirements as set forth through ORS 86A. All licensing candidates should familiarize themselves with ORS 86A to ensure that they act compliantly throughout all their daily professional activities.

Module 3: Licensing of Mortgage Bankers and Mortgage Brokers

Licensed mortgage brokers and bankers are responsible for supervising the activities of the mortgage loan originators associated with their broker or banker license. In this chapter we'll introduce the licensing requirements for mortgage brokers and bankers, how mortgage brokers and bankers hire MLO licensees, branch office registration, proper use of assumed business names, and a licensee's reporting requirements to the NMLSR.

Module 4: Licensing of Mortgage Loan Originators

Individuals who desire to offer or negotiate residential mortgage loans with the expectation of compensation are required to be licensed as mortgage loan originators. In this chapter we'll explain the process of becoming licensed as an MLO, the annual license maintenance requirements, and status changes that need to be submitted to the NMLSR.

Module 5: Dishonest, Fraudulent, Unfair, and Unethical Practices

All licensees within this state are prohibited from participating in activities that are fraudulent, misleading, or deceptive towards consumers. This chapter will list the prohibited activities that may result in disciplinary actions against an Oregon licensee.

Module 6: Custody and Possession of Client Funds

Funds supplied by a client during their residential mortgage loan transaction are to be handled by specific rules relating to trust funds. This chapter covers the regulations regarding caring for funds that belong to others.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

4 Hour WA SAFE: Washington Mortgage Lending Laws

NMLS Course ID: 11656

NMLS Sponsor ID: 1400327

Credit Hours Provided: 4

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Washington under the Washington State Department of Financial Institutions (DFI). This 4-hour course covers Washington specific rules and regulations, and is required as part of the 20 hours of prelicensure education needed to become an Washington mortgage loan originator.

Topics and Learning Objectives

This course consists of four modules and a final exam:

- Mortgage Lending Licensing (45 minutes)

- Maintaining a License (45 minutes)

- Security Devices (45 minutes)

- State Conduct Rules (45 minutes)

- Final Exam (20 minutes)

Total study time: 4 clock hours

Module 1: Mortgage Lending Licensing

In this chapter we'll introduce you to the government agency that oversees the mortgage industry in our state, the Washington State Department of Financial Institutions (DFI). We'll also introduce you to the Mortgage Broker Practices Act (MBPA) and the Consumer Loan Act (CLA), the state laws the define the authorization requirements for license applicants as well as the conduct of licensed mortgage loan originators and mortgage brokers.

Module 2: Maintaining A License

After being granted a license by the Department of Financial Institutions, a licensee is required to conduct themselves under the rules of the department. In this chapter we'll explain how to renew a license, the record keeping requirements expected of licensees, and how to comply with DFI requirements. Trust account regulations will also be covered, outlining a mortgage broker's responsibilities when handling funds given to them in trust. Licensees also have reporting responsibilities to the DFI when information about their license status changes such as legal name changes, email address updates, or if criminal charges have been filed against the licensee.

Module 3: Security Devices

In this chapter we'll break down various types of security devices: promissory notes, deeds of trusts, and mortgages. First we will outline the components of a promissory note and how these notes may be negotiable. Then we'll describe both mortgage and trust deeds, the security interest the lender has in the property, and discuss the differences between these two security instruments. You'll also learn what happens when a borrower's security instrument must be foreclosed because the borrower cannot comply with their promise to repay.

Module 4: State Conduct Rules

In this last chapter, we'll outline the activities and conduct that a licensee cannot participate in under Washington. If the DFI finds a licensee has partaken in activities that harm consumers or the lending industry, the agency has the authority to punish the licensee by imposing fines and removing a licensee's authorization to conduct lending activities in this state. We'll also describe what information must be outlined in writing by a licensee to be disclosed to a consumer or borrower, and identify fees that can be counted towards a licensee's commission for successfully walking a borrower through their loan.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

3 Hour NM SAFE: New Mexico Mortgage Lending Laws

NMLS Course ID: 13145

NMLS Sponsor ID: 1400327

Credit Hours Provided: 3

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in New Mexico under the New Mexico Financial Institutions Division (FID). This 3-hour course covers New Mexico specific rules and regulations, and is required as part of the 20 hours of prelicense education needed to become a NM-licensed mortgage loan originator.

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in New Mexico under the New Mexico Financial Institutions Division (FID). This 3-hour course covers New Mexico specific rules and regulations, and is required as part of the 20 hours of prelicense education needed to become a NM-licensed mortgage loan originator.

Topics and Learning Objectives

This course consists of five modules and a final exam:

Mortgage Acts and Authority (20 minutes)

New Mexico Licensure Steps (18 minutes)

Complying with the Mortgage Loan Company Act (22 minutes)

Complying with the Mortgage Loan Originator Licensing Act (20 minutes)

The New Mexico Home Loan Protection Act (50 minutes)

Final Exam (20 minutes)

Total study time: 3 clock hours (150 minutes)

Module 1: Mortgage Acts and Authority

The New Mexico Financial Institutions Division (FID) is the state agency in charge of consumer financial protection, ensuring a safe environment for lending in our state, and licensing and regulating those who want to work in the industry at such locations as banks, escrow companies, credit unions, and mortgage loan companies. This chapter introduces the FID and its Director, and presents industry terms that will be used throughout the course.

Module 2: New Mexico Licensure Steps

Before you can accept a residential mortgage loan application from a potential borrower, or offer to arrange or negotiate a loan transaction for an applicant, with the expectation of being compensated for your efforts, you need to be licensed as a mortgage loan originator. This module will explain the requirements for obtaining an MLO license from the Financial Institutions Division.

Module 3: Complying with the Mortgage Loan Company Act

Once a mortgage company or mortgage originator has obtained a license under the Mortgage Loan Company Act or the Mortgage Loan Originator Licensing Act, the licensee must follow rules and procedures contained in the Acts. The Financial Institutions Division of the Regulation and Licensing Department has a number of enforcement and sanction powers should a licensee or an affiliate not comply with the Acts or the terms of their license.

This module will analyze the regulations expected of licensees who are licensed under the Mortgage Loan Company Act (MLCA) can

Module 4: Complying with the Mortgage Loan Originator Licensing Act

In writing and passing the Mortgage Loan Originator Licensing Act, the New Mexico legislature emphasized the importance of mortgage loan origination services to the state’s people, communities, and economy. At the same time, lawmakers said, reasonable licensing and regulatory standards are "essential for the protection of the residents of New Mexico and the stability of New Mexico’s economy[.]" (NM Stat 58-21B-2.A) With this explicit consumer-protection focus, the Act contains more requirements, and is in some ways more specific in those requirements, than the Mortgage Loan Company Act.

In this module, we'll cover the acts outlined by the MLOLA that mortgage loan originators must follow as part of the authorization given to them as a New Mexico licensee.

Module 5: The New Mexico Home Loan Protection Act

The New Mexico Home Loan Protection Act (HLPA) contains rules and regulations intended to protect New Mexico residential mortgage borrowers from deceptive acts initiated by tricky lenders. This module dives into the details of the act, the restrictions it places on creditors, and the safeguards it gives to consumers.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

2 Hour MT SAFE: Montana Mortgage Lending Laws

NMLS Course ID: 11823

NMLS Sponsor ID: 1400327

Credit Hours Provided: 2

Category: PE Elective

This course is designed to prepare candidates to take the exam to become a state-licensed mortgage loan originator in Montana under the Division of Banking and Financial Institutions (DBFI). This 2-hour course covers Montana specific rules and regulations, and is required as part of the 20 hours of prelicensure education needed to become a Montana mortgage loan originator.

Topics and Learning Objectives

This course consists of two modules and a final exam:

- The Montana Mortgage Act

- Administrative Rules of Montana

- Final Exam

Total study time: 2 credit hours (100 minutes)

Module 1: The Montana Mortgage Act

This module will explain the Montana Mortgage Act, 32-9-101 MCA through 32-9-172 MCA. This act outlines the licensing regulations of the residential mortgage industry in our state. The intention of the act is to promote honesty, education, and professionalism; to ensure the availability and diversity of residential mortgage funding; and to protect Montana consumers and the stability of Montana's economy.

Module 2: Administrative Rules of Montana

This module will explain the administrative rules of the Montana Department of Administration (DOA) and its Division of Banking and Financial Institutions (DBFI). The Administrative Rules of Montana (ARM) define the recordkeeping requirements of licensees relating to file such as disclosures, applications, advertisements, and complaints.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID, but don't remember what it is:

- Login into NMLS,

- Click on the Composite View tab, then

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students for 365 days after enrollment.

NMLS Mortgage Licensing Exam Test-Taking Strategy Course

The NMLS Test-Prep Webinar will provide you with:

- information on how to schedule your NMLS examination,

- insight as to what you can expect upon arriving at the testing center,

- proven test-preparation and study strategies as well as test-taking techniques that work,

- instruction on how to effectively utilize the NMLS Test Content Outline,

- Eighteen (18) additional study sources,

- the opportunity to sign up for one-on-one, personalized test-prep tutoring.

This video course session will share proven exam-taking and study strategies with you that have assisted numerous test candidates build their confidence and pass this exam. Created and delivered by a seasoned mortgage professional, mortgage instructor, and trainer, this video class can increase your odds of knocking the NMLS national mortgage licensing examination out of the park on your first attempt. Think of this as an investment in yourself, your career, and your success. Can you really afford not to? Sign up today!

A live (webinar) version of this course is also available for registration. The live version allows you to interact with the course instructor in a Question & Answer session, covering topics you may need additional guidance in before taking your MLO license examination.

About Your Instructor

Rich Leffler is the President, CEO, and Senior Instructor of AxSellerated Development, LLC, a success coaching and mortgage consulting firm dedicated to assisting others achieve personal and professional success. In addition to being a charismatic, captivating, and sought-after personal success coach, instructor, NMLS exam tutor, and speaker, Rich is responsible for creating, coordinating, and executing training curriculums affording new mortgage loan originators and those considering a career in mortgage lending with the fundamental skills necessary to originate successfully and compliantly.

This course will remain available to students for 365 days after enrollment.