https://www.onlineed.com/catalog/1868/12h-NJ-NMLS-Late-CE

Late CE 12 Hours of 2024 New Jersey MLO Continuing Education

Late CE 12-hour package for New Jersey mortgage license renewal. Includes state electives for both NJ and NY.

$105.00 | 12 Hours

+ $18.00 NMLS Credit Banking Fee

Approved for Late CE only.

This course package satisfies 12 hours of continuing education required for mortgage loan originators licensed in the state of New Jersey. This package includes three separate courses:

-

Late CE 2 Hour NJ SAFE: New York Mortgage Continuing Education

-

Late CE 3 Hour NY SAFE: New York Mortgage Continuing Education

-

Late CE 7 Hour SAFE Core: 2024 Originator Fundamentals

NOTE: New York Bundled Course Elective - This package is bundled with a New York state CE elective course. This course is necessary to meet New Jersey's 12-hour total CE requirement. New Jersey only mandates a 2-hour state specific elective course, but requires several additional hours of electives. Since many of our students are living in New Jersey but also work in New York, this package covers license renewal requirements for both states. If you are not licensed in New York, you still need to complete the New York course to meet New Jersey's hour requirements. You may optionally take any other elective course to make up the necessary hours.

Learn More

Key Features

NJ Elective

NY Elective

Online Course

Includes Video

Printable Certificate

PDF & EPUB eBook

Read-Along Audio MP3 Add +$5.00

Package Summary

| Price: |

$105.00 (USD)

+ $18.00 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 12 |

| State: | New Jersey |

| Category: | Vocational Training > Mortgage > Continuing Education > New Jersey > CE Elective |

| Purpose: | Late CE 12-hour package for New Jersey mortgage license renewal. Includes state electives for both NJ and NY. |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

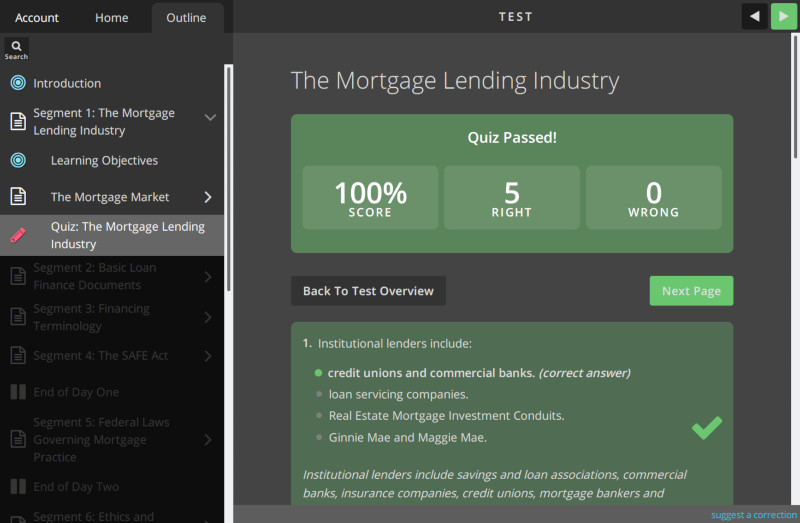

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

New Jersey Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.

Courses Included In This Package:

Late CE 3 Hour NY SAFE: New York Mortgage Continuing Education (15986)

NMLS Course ID: 16775

NMLS Sponsor ID: 1400327

Credit Hours Provided: 3

Category: CE Elective

This course is approved for "Late CE" credit only.

The New York State Department of Financial Services (DFS) requires New York mortgage licensees to complete a total of 11 continuing education hours each year: 3 hours of federal law, 2 hours of ethics, 2 hours of non-traditional mortgages, 1 hour of general elective, and 3 hours of New York specific education. This three-hour online course meets the New York state-specific mortgage licensee continuing education requirements for annual license renewal.

This course begins with an explanation of mortgage lending consumer protection in regards to high-cost home loans, subprime loans, fair lending, and home equity theft prevention. The second module of this course identifies and lists the various disclosures that will educate consumers on areas such as advertising home loan products, loan commitment, secondary mortgages, and late fees. The third and last module will review prohibited conduct.

Not every state agency allows for reinstatement of a license. Check the Annual Renewal Information page on the NMLS website to verify if the agency you are licensed under allows for reinstatement, when the last date of reinstatement is, and what the applicable penalty fees may be.

https://mortgage.nationwidelicensingsystem.org/slr/common/renewals/Pages/default.aspx

Topics and Learning Objectives

This course is broken down into several learning topics. At the end of the course a 25-question final exam will be given. The topics included in this course are:

Module 1: Mortgage Lending Consumer Protections

Module 2: New York State Mortgage Disclosures

Module 3: MLO Authority and Prohibited Conduct

Final exam

Total study time: 3 credit hours (150 minutes)

This course will prepare New York DFS-licensed MLOs to:

- Generalize what defines a loan as a high-cost home loan and the extra requirements that must be complied with when originating these types of loans.

- Identify the criteria that makes a loan categorized as a subprime loan.

- Review New York's fair lending regulations and the steps the Superintendent takes when investigating a fair lending complaint.

- List the protections given to consumers who are working with a distressed property consultant or equity purchaser.

- Summaries the various disclosures that must be given to consumers relating to applications, advertisements, loan commitments, prevailing rates, hazard insurance, agency, lock-in agreements, junior liens, and alternative mortgage loans.

- Give examples of events that require a crime report to be filed with the Superintendent.

- Review the licensing requirements for New York MLOs as well as prohibited conduct.

- Describe the recordkeeping and reporting requirements for licensee.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

- Login into NMLS

- Click on the Composite View tab.

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students until midnight on December 31st, 2025

Late CE 2 Hour NJ SAFE: New Jersey Mortgage Continuing Education (16003)

NMLS Course ID: 16773

NMLS Sponsor ID: 1400327

Credit Hours Provided: 2

Category: CE Elective

This course is approved for "Late CE" credit only.

The New Jersey Department of Banking and Insurance (DOBI) requires New Jersey mortgage licensees to complete a total of 12 continuing education hours each year: 3 hours of federal law, 2 hours of ethics, 2 hours of non-traditional mortgages, 3 hours of general elective, and 2 hours of New Jersey specific education. This two-hour online course meets the New Jersey state-specific mortgage licensee continuing education requirements for annual license renewal.

This course covers the New Jersey Residential Mortgage Lending Act, the laws that define mortgage licensing, conducts, and restrictions in this state. The first module of this course is an overview of the state department tasked with overseeing mortgage regulations, the Department of Banking and Insurance. The second module will review mortgage licensing requirements, and the third module covers the authority of the Commissioner of DOBI, various prohibited acts that licensees cannot do when working with consumers, and specific restrictions when dealing with junior liens and secondary mortgages.

Not every state agency allows for reinstatement of a license. Check the Annual Renewal Information page on the NMLS website to verify if the agency you are licensed under allows for reinstatement, when the last date of reinstatement is, and what the applicable penalty fees may be.

https://mortgage.nationwidelicensingsystem.org/slr/common/renewals/Pages/default.aspx

Topics and Learning Objectives

This course is broken down into several learning topics. At the end of the course a 15-question final exam will be given. The topics included in this course are:

- Module 1: Overview of the Department of Banking and Insurance (12 minutes)

- Module 2: The New Jersey Residential Mortgage Lending Act (45 minutes)

- Module 3: NJRMLA Restrictions and Regulations (33 minutes)

- Final exam (10 minutes)

Total study time: 2 credit hours (100 minutes)

Module 1: Overview of the Department of Banking and Insurance (DOBI)

In this module we will summarize the organization and purpose of the State of New Jersey Department of Banking and Insurance (DOBI).

At the conclusion of this course, you'll be able to:

Describe the mission of DOBI and recognize the individuals who oversee the Department.

Module 2: The New Jersey Residential Mortgage Lending Act (NJRMLA)

In this module we'll cover the mortgage licensing requirements as defined by the New Jersey Residential Mortgage Lending Act.

At the conclusion of this course, you'll be able to:

Review various terms as defined in the Residential Mortgage Lending Act.

Describe the licensing requirements for New Jersey lenders, brokers, and MLOs.

Module 3: NJRMLA Restrictions and Regulations

At the conclusion of this course, you'll be able to:

Identify the authority of the DOBI Commissioner.

Memorize the recordkeeping periods and the Commissioner's examination authority

Define the rules relating to including credit and hazard insurance into a loan

Recognize licensee conduct prohibited by the New Jersey RMLA.

Explain the requirements for originating second lien (secondary) mortgages.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

- Login into NMLS

- Click on the Composite View tab.

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center.

This course will remain available to students until midnight on December 31st, 2025

Late CE 7 Hour SAFE Core: 2024 Originator Fundamentals (16050)

NMLS Course ID: 16770

NMLS Sponsor ID: 1400327

Credit Hours Provided: 7

Category: CE Elective

This course is approved for "Late CE" credit only.

This course will instruct mortgage loan originators on a number of regulations that they will have to comply with while taking part in their mortgage loan origination activities. Rules, such as those implemented by the Dodd-Frank Wall Street Reform and Consumer Protection Act, are set in place to protect the interest and well-being of consumers who apply for mortgages to purchase or refinance their properties. To ensure that their business practices satisfy the regulations adopted by federal laws, mortgage loan originators need to keep current on the guidelines published by entities such as the Consumer Financial Protection Bureau (CFPB).

Not every state agency allows for reinstatement of a license. Check the Annual Renewal Information page on the NMLS website to verify if the agency you are licensed under allows for reinstatement, when the last date of reinstatement is, and what the applicable penalty fees may be.

https://mortgage.nationwidelicensingsystem.org/slr/common/renewals/Pages/default.aspx

Topics and Learning Objectives

This course consists of four sections and a final exam

Top 10 Federal Topics for 2024

Ethical Mortgage Advertisement Practices

The Fannie Mae HomeStyle® Renovation Loan

- Final exam

Total study time: 7 credit hours (5 hours, 30 minutes)

Module 1: Top 10 Federal Topics for 2024

Study Time: 3 clock hours (150 minutes of federal law)

air lending along with compliance to the law, established rules, and implemented regulations is everyone’s responsibility. When compliance failures occur, everyone, including the customer, loses.

The topics outlined in this module are mandated by the NMLS and state regulators, covering the more egregious regulatory compliance failures recently discovered through various regulatory examinations, investigations, and audits.

Module 2: Ethical Mortgage Advertisement Practices

Study Time: 2 clock hours (100 minutes of ethics, fraud, and consumer protection)

Most, if not all of the regulations for the mortgage and banking industry are implemented to protect the consumer. That is what this module is about - consumer protection in advertising. Throughout this module, we hope to provide you a better understanding of the laws designed to protect consumers from untruthful mortgage advertising and understanding what you can and cannot do when advertising your loan products. Your proper understanding of these rules is vital when dealing with the public and promoting your services.

Module 3: The Fannie Mae HomeStyle Renovation Loan

Study Time: 2 clock hours (100 minutes of non-traditional mortgage)

In this next section, we will explore property rehabilitation loan products. Over the years, most of us have become familiar with the FHA 203(k) Rehab Loan. It was the loan program that many mortgage loan originators turned to when they needed a rehab loan program for their borrower client.

Today, there are other options available when it comes to rehabilitating a home for purchase and refinance that may more perfectly fit the rehab loan needs of the borrower. This module will introduce you to one such program: the Fannie Mae HomeStyle Rehab loan program. We'll explain the details of this program and compare it to the traditional 203(k) rehab loan.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

- Login into NMLS

- Click on the Composite View tab.

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center

This course will remain available to students until midnight on December 31st, 2025