https://www.onlineed.com/catalog/582/West-VIrginia-2-Hour-NMLS-CE

2 Hour WV SAFE: West Virginia Mortgage Continuing Education

NMLS Course ID: 15982

NMLS Sponsor ID: 1400327

Credit Hours Provided: 2

Category: CE Elective

The West Virginia Division of Financial Institutions (WVDFI) requires mortgage licensees in this state to take a two-hour course on West Virginia mortgage lending rules as part of the licensees' annual continuing education requirement for license renewal. This course covers topics relating to West Virginia mortgage regulations.

The West Virginia Division of Financial Institutions (WVDFI) requires mortgage licensees in this state to take a two-hour course on West Virginia mortgage lending rules as part of the licensees' annual continuing education requirement for license renewal. This course covers topics relating to West Virginia mortgage regulations.

This five-module course will begin with an overview of the WVDFI and its Board of Banking and Financial Institutions. We'll then cover mortgage disclosure and advertising rules, conditions and limitations on certain mortgage transactions, and regulations relating to residential mortgage loans. Finally we'll review licensing requirements and prohibited conduct.

Topics and Learning Objectives

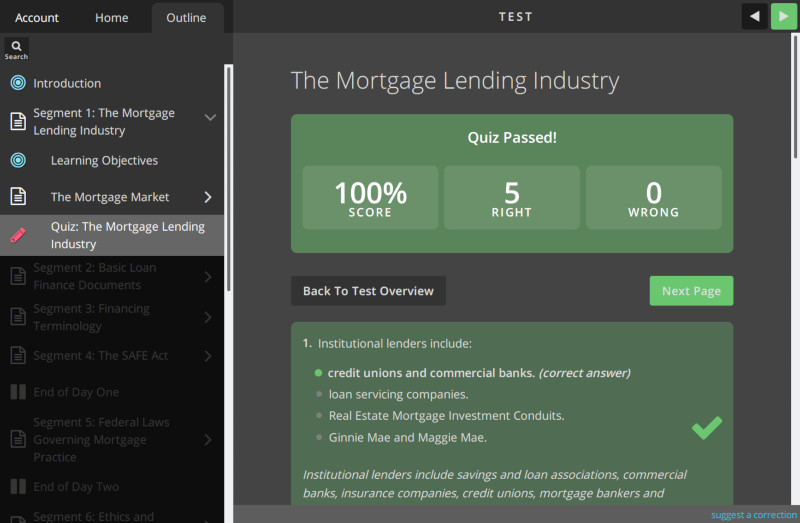

This course is broken down into several learning topics. At the end of the course a 15-question final exam will be given. The topics included in this course are:

- The Division of Financial Institutions

- Disclosures and Advertising

- Conditions and Limitations for Certain Mortgage Transactions

- Residential Mortgage Loans

- License Maintenance and Renewal

- Final exam

Total study time: 2 credit hours (100 minutes)

This course will prepare West Virginia DOFI-licensees to:

- Describe the purpose of the West Virginia Division of Financial Institutions (WVDFI)

- Identify the powers of the Board of Banking and Financial Institutions

- Describe the Tangible Net Benefit requirements and demonstrate proper completion of the WV statutorily required form.

- Discuss the records that must be maintained per CSR 106-5.

- Illustrate the requirement that an MLOs NMLS unique identifier is displayed on all advertising, including social media.

- Know the late payment penalty maximum charge of $30.00 and describe the requirement that this be disclosed correctly on all loan disclosures.

- Explain the loan-to-value limitation of 100%, unless program is specifically exempted by statute.

- Know that no application fees may be collected. Explain that third party pass through fees may be collected for the actual amount of the service provided.

- Recite fee limitations.

- Explain that no instrument evidencing or securing a primary or subordinate loan may contain a requirement that the final installment be greater than any other installment (balloon).

- Explain the restriction on use of the term banker.

- Discuss the explanation and documentation required if a non-local appraiser (greater than 75 miles) is used.

- Examine the determination of ability to repay (or exemption from the requirement). If debt-to-income ratio exceeds 50%, a written assessment containing certain information must be signed by the lender or lender’s representative and the borrower.

- Describe the requirements regarding the Good Funds Settlement Act.

- Outline the requirements for Lender licensing and Broker licensing under the act

- Recognize the reasons in which the Commissioner of Financial Institutions may deny, revoke, or suspend an issued license

- Describe the registration, education, and testing requirements for mortgage loan originator applicants

- Review the supervisory powers the Commissioner has over its licensees

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

- Login into NMLS

- Click on the Composite View tab.

- Click View Individual on the sub-header row.

- The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center.

This course will remain available to students until midnight on December 31st, 2024

Learn More

Key Features

Online Course

Online Audio

Printable Certificate

PDF & EPUB eBook

Package Summary

| Price: |

$29.50 (USD)

+ $3.00 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 2 |

| State: | West Virginia |

| Category: | Vocational Training > Mortgage > Continuing Education > West Virginia > CE Elective |

| Purpose: | 2-hour West Virginia state-specific course for DOFI-licensed mortgage loan originators |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

West Virginia Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.