https://www.onlineed.com/catalog/683/1-Hour-UT-DRE-SAFE-Utah-Mortgage-Continuing-Education

1 Hour UT-DRE SAFE: Utah Mortgage Continuing Education

1-hour Utah state-specific course for licensed mortgage loan originators.

$24.50 | 1 Hour

+ $3.00 NMLS Credit Banking Fee

1 Hour UT-DRE SAFE: Utah Mortgage Continuing Education

NMLS Course ID: 17424

NMLS Sponsor ID: 1400327

Credit Hours Provided: 1

Category: CE Elective

The Utah Division of Real Estate (DRE) require those who hold a Utah mortgage license to complete a one-hour course on Utah mortgage laws and regulations as a requirement for annual license renewal. This online course covers the required topics as defined by the DRE for license renewal through the NMLS.

The Utah Division of Real Estate (DRE) require those who hold a Utah mortgage license to complete a one-hour course on Utah mortgage laws and regulations as a requirement for annual license renewal. This online course covers the required topics as defined by the DRE for license renewal through the NMLS.

This one-hour course will cover the topics outlined by the DRE. We'll start with updates to the Utah Residential Mortgage Practices and Licensing Act. Next, we'll cover several topics recommended by the Division such as reverse mortgages. Finally, we'll look over the importance of protecting information submitted by Utah loan applicants and the simultaneous roles a mortgage licensee is prohibited from acting in during a loan transaction to prevent conflicts of interest.

Topics and Learning Objectives

This course consists of three modules and a final exam:

Utah Residential Mortgage Practices and Licensing Rule Changes

Utah Reverse Mortgage Act

Mortgage Commission Suggested Topics

- Final exam

Total study time: 1 clock hour

After completing this course, students will be able to

review the responsibilities of a lending manager including supervision, enforcing policies, recordkeeping, and disclosing adverse security breaches.

outline an entity's requirement to protect customer information and the proper process to dispose of sensitive customer material.

describe available reverse mortgage products.

identify the age requirements for reverse mortgage consumers.

describe the home counseling requirements.

identify changes to the cooling-off period after reverse mortgage loan closing.

note the date that covered institutions under the Gramm-Leach-Bliley Act had to develop their revised safeguard rules.

identify working roles that could put the licensee in a conflict of interest situation.

NMLS ID Required

You must have an NMLS ID to receive credit for this course. You will need this number before you begin the course.

If you already have an NMLS ID but don't remember what it is:

Login into NMLS

Click on the Composite View tab.

Click View Individual on the sub-header row.

The number that appears in parentheses after your name is your NMLS ID number.

If you do not have an NMLS ID and need to obtain one, use the instructions available in the NMLS Resource Center:

https://mortgage.nationwidelicensingsystem.org/licensees/resources/LicenseeResources/Create-an-Individual-Account-Quick-Guide.pdf

This course will remain available to students until midnight on December 31st, 2025

Learn More

Key Features

Online Course

Online Audio

Printable Certificate

PDF & EPUB eBook

Package Summary

| Price: |

$24.50 (USD)

+ $3.00 NMLS Credit Banking Fee |

|---|---|

| Credit Hours: | 1 |

| State: | Utah |

| Category: | Vocational Training > Mortgage > Continuing Education > Utah > CE Elective |

| Purpose: | 1-hour Utah state-specific course for licensed mortgage loan originators |

Course Provider

OnlineEd

14355 SW ALLEN BLVD STE 240,

Portland, OR 97223

(503) 670-9278

mail@onlineed.com

NMLS Course Provider ID: 1400327

Enrollment Agreement

Purchase of this package requires that you read and acknowledge an Enrollment Agreement before receiving credit for any courses contained in this package. Please review the following:

Our Mission Statement

To provide superior distance education that exceeds industry standards and expectations in course content and delivery methods to those who seek to enter a new profession and those engaged in a profession.

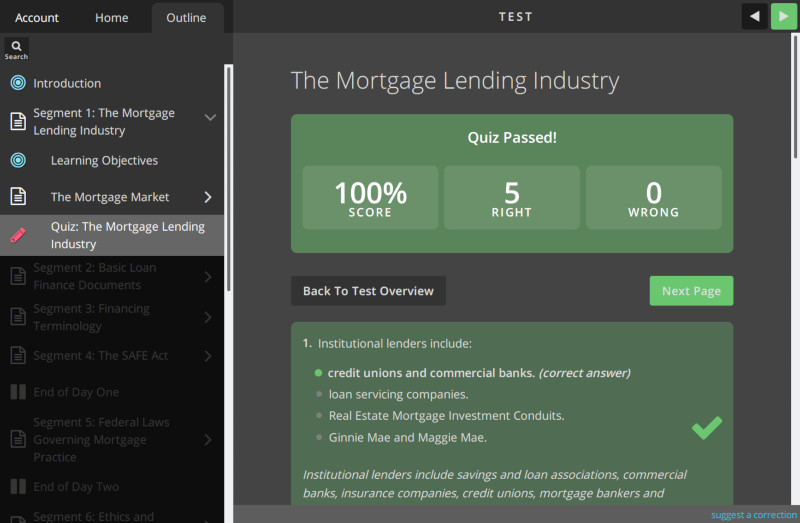

Try the Demo!

Try a live demonstration of the OnlineEd learning management system

Utah Education Guidelines

Get detailed information on the education requirements for topics, credit hours, and licensing.